Bessent Pressures Banks to Review Immigrant Accounts

In Congressional hearings last week, the Treasury Secretary doubled down on the use of financial warfare to achieve political ends.

"If you're here illegally, there's no place for you in our financial system," Treasury Secretary Scott Bessent said in a post on X last year in response to a FinCEN alert on cross-border funds transfers. On Thursday, he was reminded of these words before the Senate Banking Committee, as Congress asked for a status update on the Treasury's measures to fight illegal immigration.

Bessent stated that he has had regulators “double down on KYC, to make sure that everyone in the regulated banking system is legal,” adding that "we are encouraging banks to be more proactive," and that "we are considering a reunderwriting of the clients."

Referring to Minneapolis as "a hotbed of waste," the Secretary added that much fraud and abuse happens outside of the banking system in money service businesses that send money out of the country. "This is a vulnerability we've spotted in our system and we are cracking down on that." In early January, the Treasury issued a geographic targeting order that lowered currency reporting requirements from 10,000 USD to 3,000 USD.

"We've also cracked down at the Southern border," Bessent said, "because we've found that lots of cartels are using or money laundering there and we've done that in a targeted basis rather than increasing cost to all banks." Last year, the Treasury lowered the currency reporting requirements in 30 jurisdictions around the Mexican border from 10,000 USD down to 200 USD.

The measures, according to Bessent, are necessary as many Suspicious Activity Reports (SARs) are filed “after the horse has left the barn.”

“I do believe in financial surveillance for remittances that should not be remitted," Bessent concluded, "and we should also know where the money is going.” If implemented, the orders are likely to increase account closures for customers holding foreign names due to a rise of servicing costs.

Debanking Political Opponents

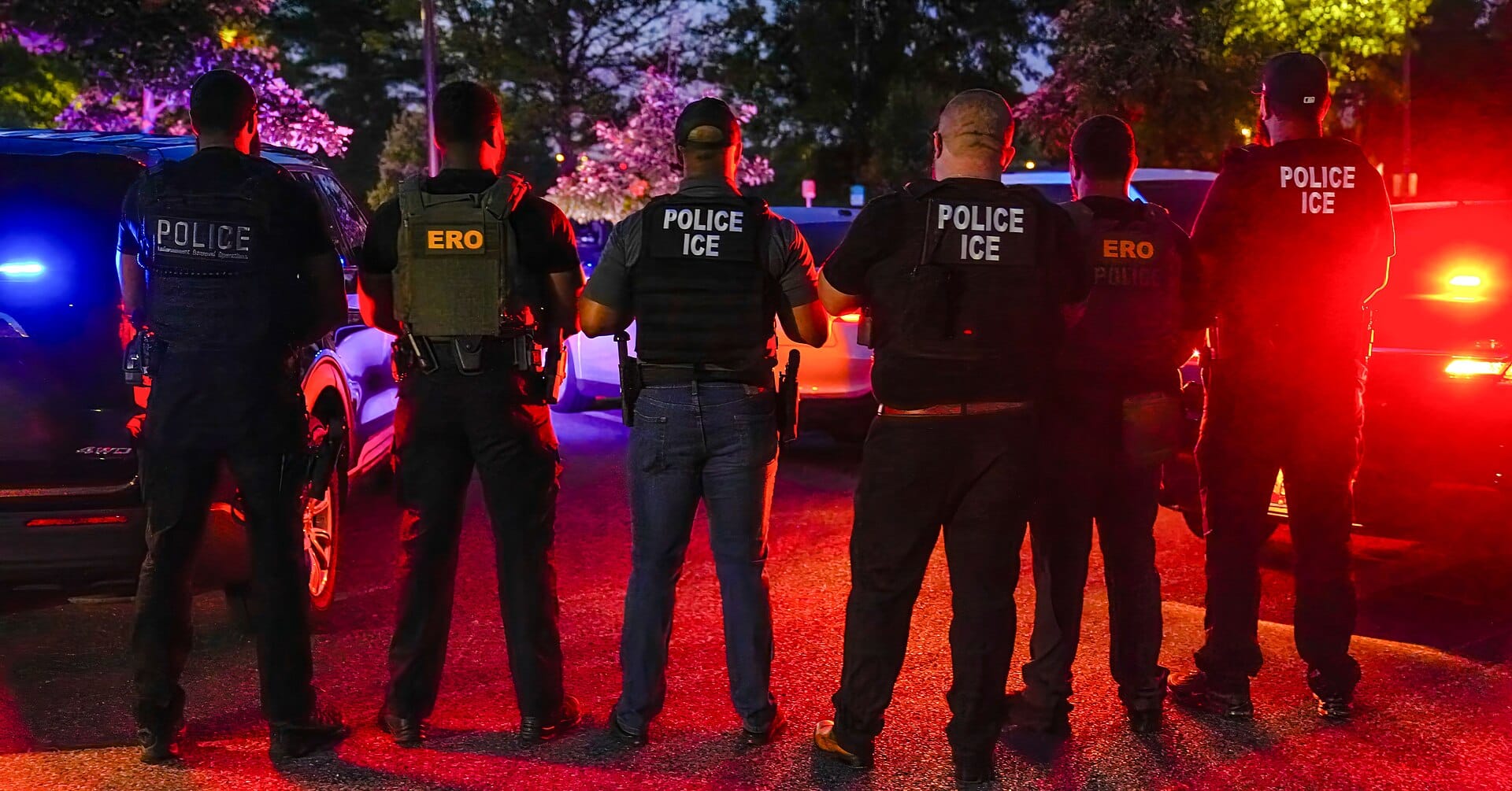

Bessent refused to retract a statement he made suggesting that Alex Pretti, who was shot by ICE agents in Minneapolis in January, was culpable in his own killing for carrying a licensed firearm to a protest, as others in the administration referred to Pretti as a domestic terrorist.

A disturbing video filmed by a bystander to an ICE enforcement action in the week of Pretti's killing showed a federal agent threatening a woman filming with being put in "a nice little database, and now you’re considered a domestic terrorist" for exercising her First Amendment rights.

In October, the White House designated Antifa a domestic terrorist organization, despite the fact that Antifa – stemming from the word antifascism – is less of a group and rather a political movement that originated in 1930s Germany in opposition to the rise of the Nazi party.

The "executive order on antifa and a related memo could prompt banks to exit progressive clients to minimize risk," wrote American Banker at the time, adding that the directive "sits uncomfortably alongside its push to prevent politicized bank account closures," and "banks will likely prioritize high-risk cases, freezing accounts and filing additional suspicious activity reports."

"The designation resembles something out of the authoritarian’s playbook," wrote Nick Anthony of Cato Institute. "Authoritarian governments around the world have labeled their opponents as 'terrorists' to cut them off from the financial system."

Using the Financial System to Topple Foreign Governments

Asked how the Treasury was handling sanctions on Iran, Bessent stated that "what we have done is created a dollar shortage in the country." In January, Iranian shopkeepers had taken to the streets to protest rising prices and shortages of goods as increased US sanctions caused Iran's financial system to collapse.

"This came to a grand culmination in December when one of the largest banks in Iran went under," Bessent continued. "There was a run on the bank. The central bank had to print money. The Iranian currency went into free fall. Inflation exploded and hence we have seen the Iranian people out on the street."

In an earlier interview with Fox News, Bessent referred to sanctions as a form of "economic statecraft," adding that "it’s worked because in December, their economy collapsed. We saw a major bank go under. The central bank has started to print money. There is a dollar shortage. They are not able to get imports, and this is why the people took to the streets.”

The Treasury has now increased sanctions pressure against Cuba, with the UN warning of potential humanitarian collapse.

Independent journalism does not finance itself. If you enjoyed this article, please consider making a donation. If you would like to note a correction to this article, please email corrections@therage.co