New Market Structure Draft Amends Money Transmission Laws To Protect Developers

The new draft retroactively applies a control requirement to money transmitter qualifications, redefining a law unfit for the digital age.

The Senate Banking Committee has finalized a new draft of the Responsible Financial Innovation Act of 2025, also known as the market structure bill, after receiving industry feedback.

The former draft had included the so-called Blockchain Regulatory Certainty Act (BRCA), which exempted developers of non-custodial software from classifying as a money transmitter, granting a safe harbor.

The Committee's latest draft now goes well beyond the protections of the BRCA by retroactively amending existing money transmission laws and exempting non-custodial software from falling under the Bank Secrecy Act.

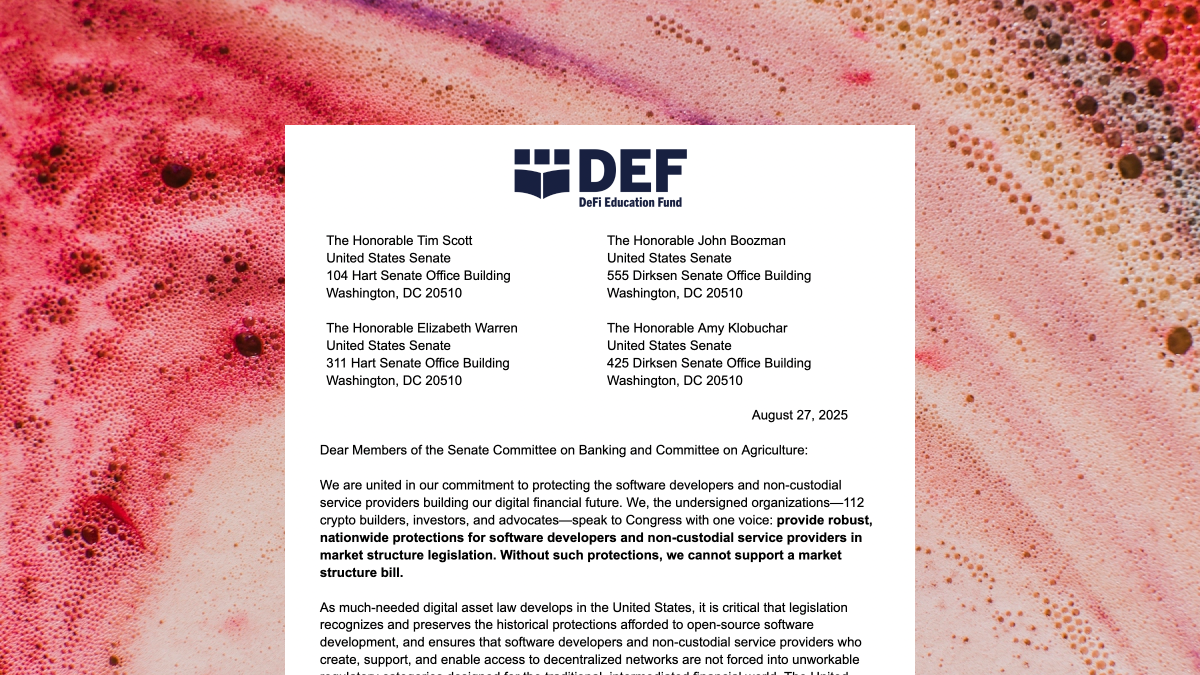

Prior to the release of the draft, over 100 industry players told the Committee that they would not support a market structure bill that does not include developer protections. A full Senate vote is expected by November or December.

But debates around the draft may become heated. This morning, Democrats published a market structure framework that calls on digital asset intermediaries to be accountable when turning a blind eye to criminal activity.

The Democrats additionally call for digital asset platforms to register with FinCEN and be regulated by the Bank Secrecy Act while proposing that market structure should "address bad actors' use of DeFi" and ensure that platforms serving US customers comply with sanctions and AML/CFT requirements.

Retroactively Amending Section 1960

The Senate's newest draft proposes to amend USC 18 Section 1960, which specifies the criminal liability of money transmitters, to include the term "control" as a prerequisite for liability.

Specifically, the draft reads that "Section 1960(a) of title 18, United States Code, is amended by inserting ‘exercises control over currency, funds, or other value that substitutes for currency and' after ‘'knowingly'." The amendment to the Section is meant to function retroactively, meaning that it does not just apply to charges going forward, but also to charges filed before enactment of the bill.

Section 1960 had previously come under scrutiny as Judge Failla, in the criminal case against Tornado Cash co-creator Roman Storm, declared the developer criminally liable under the section, stating that "a control requirement is not in the statute and this court is not going to read it in."

Storm was found guilty of conspiracy to operate an unlicensed money service business last month in a New York court and is facing up to 5 years in federal prison.

Exempting Non-Custodial Developers from the Bank Secrecy Act

In addition to amending Section 1960, the new draft exempts developers of non-custodial software to fall under Section 1960 liability, stating that "a non-controlling developer or provider shall not be treated as engaged in money transmitting, as defined in section 1960 of title 18, United States Code," or made subject to any other registration requirement that is substantially similar to a 1960 licensing requirement. Similar protections had recently passed the House in the CLARITY Act.

But the new draft now goes a step further, also exempting developers from liability under the Bank Secrecy Act. As the draft states: "a non-controlling developer or provider shall not be treated as a money transmitting business, as defined in section 5330 of title 31, United States 18 Code, and the regulations promulgated under that section."

The draft further states that developers shall not be made subject to registration requirements similar to Section 1960 or the Bank Secrecy Act after enactment. Notably, the White House had previously tasked Congress to consider expanding the Bank Secrecy Act to digital assets.

The Bank Secrecy Act had previously been a point of contention in the trial against Storm as prosecutors dropped charges under federal licensing violations – which govern the applicability of the Bank Secrecy Act – while continuing to charge Storm with knowingly transmitting illicit funds.

In court, the Government argued that while Storm was not required to apply anti-money laundering and know-your-customer measures under the BSA for the lack of a federal licensing charge, he could have implemented KYC to stop illicit activity.

Independent journalism does not finance itself. If you enjoyed this article, please consider making a donation. If you would like to note a correction to this article, please email corrections@therage.co