Prosecution Rests Its Case In Tornado Cash Trial

On Thursday, the defense opened its case with Ethereum Core developer Preston van Loon, who sued the Treasury's Office of Foreign Asset Control over sanctions on the Tornado Cash software.

US prosecutors have rested their case against Tornado Cash co-developer Roman Storm, who is charged with three counts of conspiracy, allowing Storm’s lawyers to start his defense.

The government called three witnesses to testify: IRS Special Agent Stephan George, who continued his testimony on tracing a Government witness’ funds, litigation financial analyst Connor O’Sullivan, who alleged that Storm only created the TORN utility token for profit, and a Angelica Cotto, a paralegal specialist for the Illicit Finance & Money Laundering Unit at the US Attorney’s Office, in charge of reading out emails sent to Storm inquiring about stolen funds.

Storm’s lawyers called on Ethereum Core developer Preston van Loon to open their case, who led a lawsuit against OFAC for sanctioning Tornado Cash software. Van Loon testified that he had used Tornado Cash on several occasions to protect his privacy and safety.

Defense Casts Doubt on IRS Agent’s Expertise

The trial on Thursday started with the continued cross-examination of IRS Special Agent Stephan George, who took the stand on Wednesday to testify to the tracing funds of Storm’s TORN sales, as well as to the tracing of funds from Hangfeng “Katie” Lin’s, the Government’s first witness in the trial who fell victim to a pig-butchering scam.

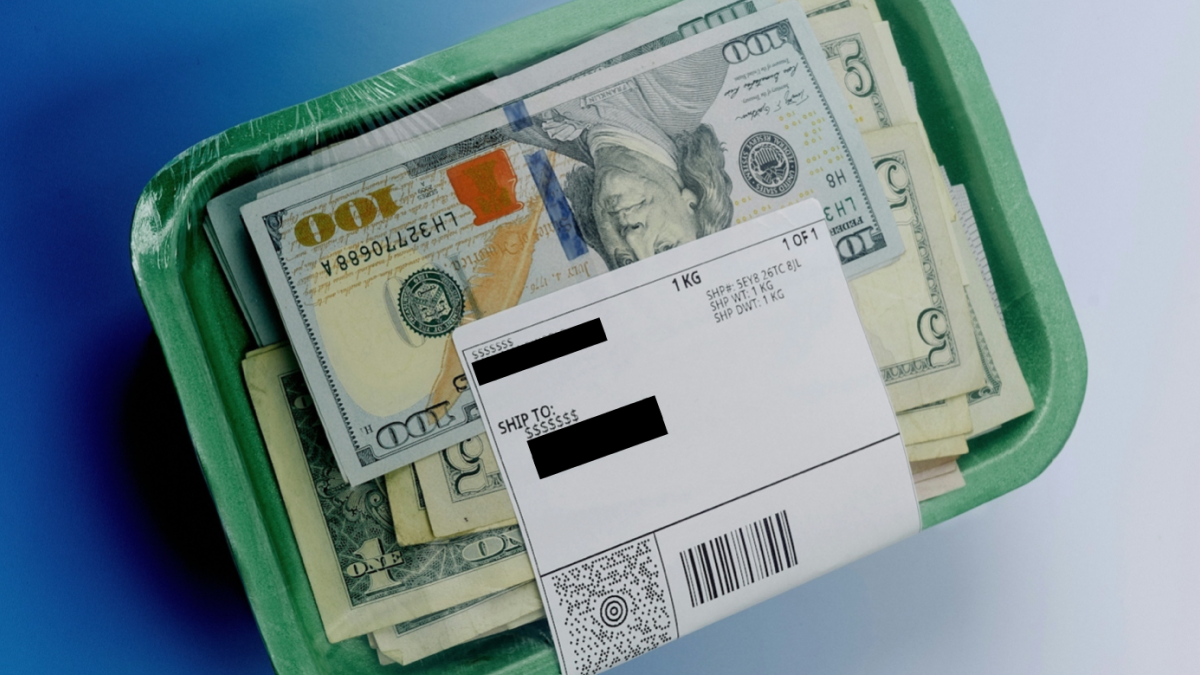

Lin’s testimony had come under heavy scrutiny as blockchain experts suggested that Lin’s money did not, in fact, go into Tornado Cash, while the recovery firm who had told her that her life savings disappeared into Storm’s service appears to be under active FBI investigation for… fraud.

Agent George’s testimony was notable for several reasons. On the one hand, the defense had attempted to prevent Agent George from testifying to the tracing of Lin’s funds as Storm’s counsel was only made aware of his testimony days before trial. But on cross-examination, Agent George stated that he was tasked to trace Lin’s funds since June or July. On the other hand, Agent George applied a tracing method known as LIFO, or Last In First Out, which experts argue to be useless in the context of blockchain tracing.

Defense attorney Keri Axel continued the cross by calling into question George’s expertise. After asking him what an ERC-20 token was, she asked whether he could differentiate between an ERC-20 token and ETH, which George did not feel comfortable testifying to. He didn’t provide an explanation, because the difference was a technical aspect that was not a factor in his work.

George also testified that he didn’t know crypto.com was an exchange, and that he didn't know the difference between BinanceUS and Binance International. BinanceUS focuses on US markets and has less cryptocurrencies available for trading compared to Binance International which serves global users. George was not aware whether Binance offered TORN tokens.

Next up was Connor O’Sullivan, a litigation financial analyst. During his testimony, the prosecution focused oun the performance of TORN compared to BTC, ETH, UNI, and COMP between February 1, 2022 and May 8, 2022. During this period, the government highlighted the process of a governance vote to jumpstart a decentralized relayer network that would give new utility for the TORN token. TORN was up 123% in the focused timeframe, while the others were in the red, according to a price diagram displayed during O’Sullivan’s testimony, suggesting that the TORN token was only created by the developers to profit from Tornado Cash, and not to provide utility to the service.

More Emails as Evidence

On Thursday, Judge Failla allowed into evidence a series of emails that were sent to Storm by people inquiring for help to find funds that went into Tornado Cash, presented by a paralegal in the Illicit Finance & Money Laundering Unit at the US Attorney's Office, Angelina Cotto. The emails were not meant to be seen as evidence of these funds going into Tornado Cash, but rather as evidence of Storm’s state of mind while developing the service.

Some of this evidence included emails from Vincent Yu from the Ministry of Justice Investigation Bureau, Taiwan, as well as Alan D. McCarthy, a detective from Ireland, who wrote to the Tornado Cash email seeking help with stolen funds.

The communications shown by the prosecution additionally entailed Storm messaging Tornado Cash co-creator and alleged co-conspirator Roman Semenov about what government agencies, such as the Federal Bureau of Investigation, could possibly accuse them of. Storm and Semenov’s messages pointed to Tornado Cash’s user interface, the frontend not having a blocklist, and access to ENS.

Prosecutors did not have any evidence that Storm directly communicated with criminals who exploited protocols and people for capital, though the prosecutors argued communication between Storm and malicious actors was not necessary to prove conspiracy. The defense maintained the position that Storm failing to prevent a crime from occurring is substantially different from an agreement to commit an unlawful activity.

All in all, the government used Cotto’s testimony to argue that Storm knew criminals were using Tornado Cash to launder their illicit funds, and that he even aimed to make the platform better for bad actors.

Storm Spoke to Investors About Implementing KYC/AML

To argue that Storm had the capacity to implement changes in Tornado Cash, and thereby actively allowed exploiters to continue using the protocol, prosecutors showed messages from Storm to various Tornado Cash stakeholders, ranging from investors such as Dragonfly Capital to employees of Peppersec, the company controlled by the Tornado Cash developers.

But the messages also showed that Storm introduced the prospect of a privacy blockchain protocol with full compliance that would act as a fork of Tornado Cash, including know-your-customer and anti-money laundering frameworks, in a group chat with venture firm Dragonfly Capital. Messages also showed Storm with Dragonfly’s managing partner, Haseeb Qureshi, about TORN token unlocks. In August 2020, Peppersec Inc. entered into a simple agreement for future equity (SAFE) for $882,000 with Dragonfly Capital, according to a document filed as evidence.

The prosecution further displayed texts between Storm and Semenov, where the two discussed selling TORN tokens. For example, Storm wrote to Semenov, “It’s necessary to sell a sweet fantasy to investors,” which prosecutors aimed to solidify as a profit motive for Storm’s alleged conspiracy.

Angelica Cotto read Storm’s messages in the courtroom, while Assistant US Attorney Than Rehn read the messages written by those who responded to Storm.

Van Loon Takes the Stand

After the prosecution rested its case, Storm’s counsel opened their defense with Ethereum Core developer Preston Van Loon, who testified using Tornado Cash four times in efforts to preserve his privacy, citing operational security and personal safety. Van Loon said he used the privacy protocol to limit the amount of publicly available financial information about him, because malicious actors could target him based on the on-chain assets he has access to.

On cross-examination, the prosecution asked van Loon whether he used other privacy services, noting that transactions made by large exchanges are not necessarily publicly traceable on the blockchain, implying that privacy services may not be necessary to shield van Loon from prying eyes.

Van Loon had previously sued the US Treasury’s Office of Foreign Asset Control (OFAC) after it imposed sanctions on the Tornado Cash software. In his suit, van Loon argued that the sanctions violated his rights to using privacy services. On appeal, the Fifth Circuit ultimately ruled that sanctions on Tornado Cash were unlawful, and that the Treasury had overstepped its authority by adding a software to OFAC’s Specially Designated Nationals list (SDN), which is commonly reserved for people, business entities, and in some cases, shipping vessels.

OFAC’s sanctions on Tornado Cash, as well as their consequent reversal, will not be discussed at Storm’s trial.

Independent journalism does not finance itself. If you enjoyed this article, please consider making a donation. If you would like to note a correction to this article, please email corrections@therage.co