Treasury Working on BSA Reform, FinCEN Director Says

While she has no idea how many BSA reports have led to arrests, reevaluating the BSA to improve efficiency is a "key objective for this administration".

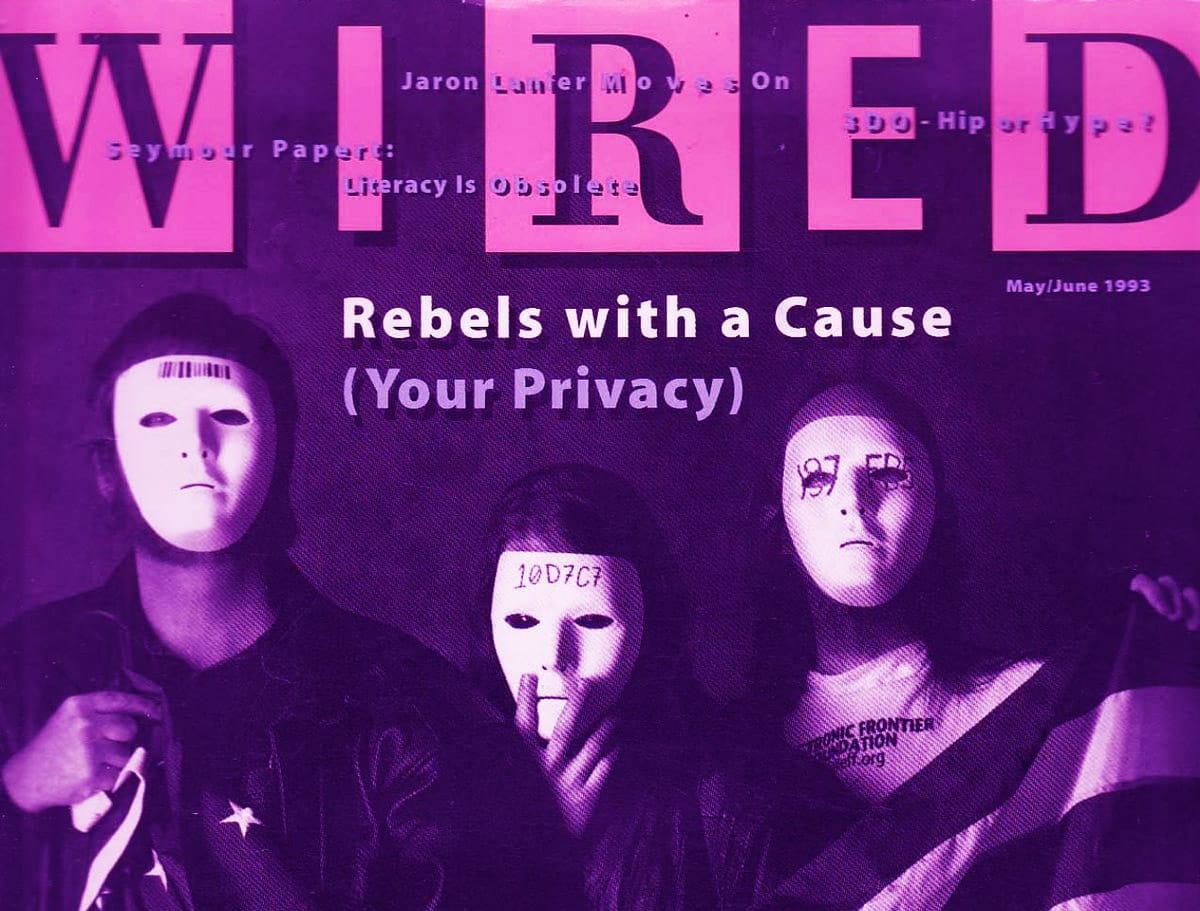

Banks hate it, businesses hate it, the people hate it, and increasingly, lawmakers are beginning to hate it too: the Bank Secrecy Act. Placing broad reporting requirements on financial institutions, causing them to collect anything from your birthday to "suspicious" transactions, the BSA has first and foremost been a complete failure in curbing financial crime.

While the Bank Secrecy Act is by far not the only piece of legislation signed into law by the ultimate illiterate Richard Nixon that's managed to screw up our financial system 55 years into the future – his other most prominent achievement in the financial world being the end of the gold standard – it is likely the most annoying one, at least for banks, businesses, and anyone trying to access their finances and should, respectfully, be sent straight to hell where it belongs, together with the idiot who authorized it.

Now, the Treasury is actively looking into reforming the BSA, said FinCEN Director Andrea Gacki in yesterday's hearing on the evaluation of the Financial Crimes Enforcement Network that took place before the GOP Financial Services Committee.

Only 5% of filed BSA Reports accessed by Law Enforcement in 9 years

Yesterday's hearing was meant to discuss the history and impact of the Bank Secrecy Act and assess these tools for targeted reforms to enhance security without trampling on privacy and innovation. The big question, according to Chairman Davidson, is "how to do it all while avoiding surveillance of law abiding citizens."

"The BSA has morphed into a bloated surveillance machine demanding endless reports from banks, businesses and individuals, without delivering proportionate results," Davidson stated, opening the hearing.

Between 2014 and 2023, law enforcement agencies only accessed about 5.4% of the millions of currency transaction reports filed under the Bank Secrecy Act, Davidson cited FinCEN's own data.

Actual crime, like Chinese Fentanyl cartels laundering Billions through US real estate, slip through because resources are tied up with data collection rather than analysis, Davidson stated.

Part of the problem seems to be that FinCEN is overwhelmed with the data it collects, Congressman Lucas found. In addition, the BSA puts sensitive personal information at the risk of hacks, Congressman Nunn added.

"I don't have those Numbers off the Top of my Head"

"We are in the midst of a Treasury wide exploration of how to reform the Bank Secrecy Act regime," Gacki stated, calling it a "key objective" of the current administration. In particular, the Treasury will be looking at reforming current reporting requirements and potentially adjusting reporting thresholds to increase the BSA's efficiency.

But not even the Director of the Treasury's own Financial Intelligence Unit was able to tell the Committee how efficient – or inefficient – the BSA really is.

"Im sorry, I dont have those numbers off the top of my head," Gacki replied to Nunn, who asked her how many of the tens of Millions of BSA reports filed each year led to actual arrests.

This is not the first time that FinCEN is clueless on the effectiveness of the BSA. When asked what percentage of the BSA reports in FinCEN’s monthly database lead to convictions in 2022, then acting Director Das responded: "we do not have precise metrics.”

Last year, Senator Mike Lee of Utah introduced the Saving Privacy Act, which would repeal suspicious activity as well as currency transaction reporting.

Independent journalism does not finance itself. If you enjoyed this article, please consider making a donation. If you would like to note a correction to this article, please email corrections@therage.co