SEC Commissioner Hester Pierce Slams Bank Secrecy Act

"We should take concrete steps to protect people’s ability not only to communicate privately, but to transfer value privately," the Commissioner says.

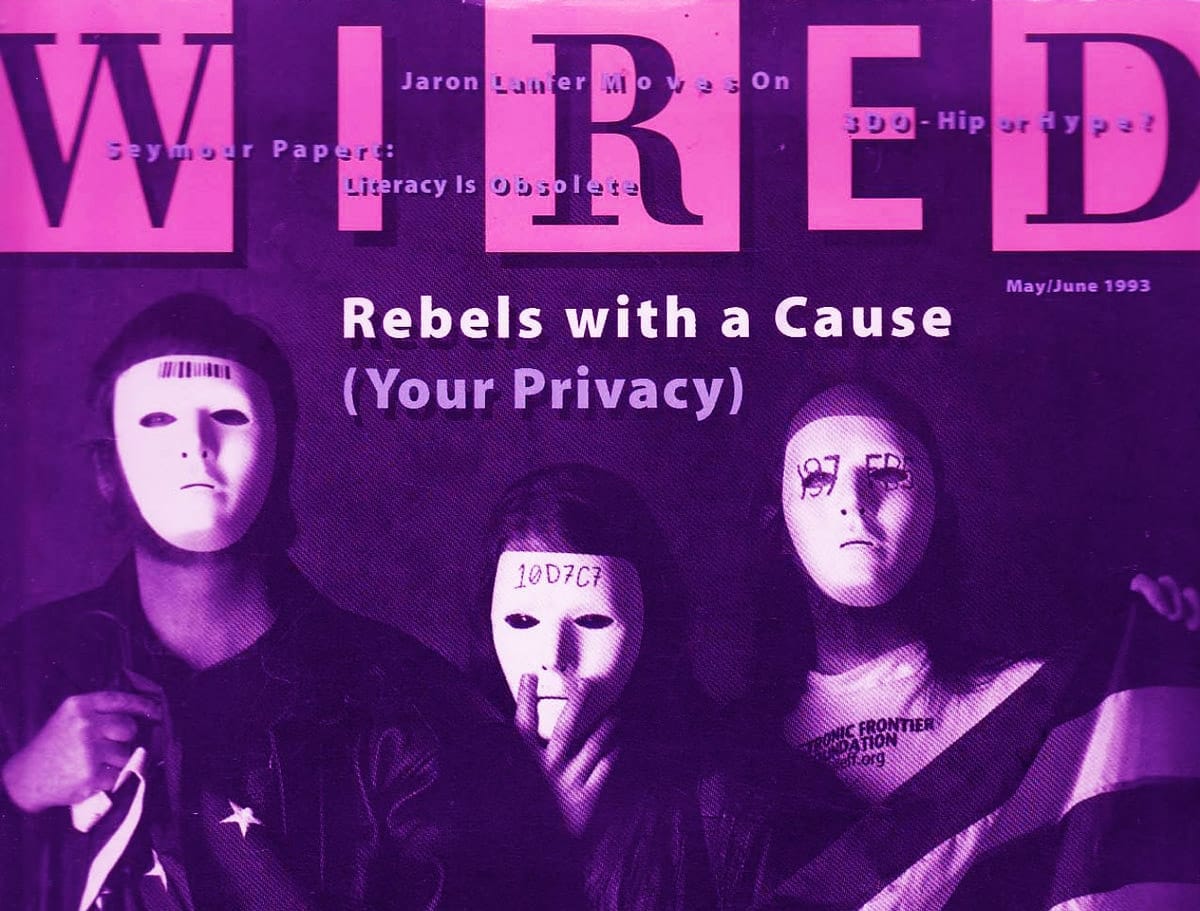

In 1993, WIRED Magazine featured a group of masked men on its cover, titled "Rebels with a Cause (Your Privacy)." The men, known as 'Cypherpunks,' built tools to protect users on the open Internet, leading law suits, guerilla protests and advocacy campaigns that would shape the legal use of encryption in digital technologies to this day.

With the advancement of Bitcoin as a peer-to-peer currency, their ideals would be translated into monetary technologies: For the first time, sending funds from A to B did not require a snooping intermediary.

Today, many figures working in Government are fighting against what may be the advent of an unsurveillable, unpermissioned financial system, just as privacy on the Internet was fought (and still is to this day). Others, like Wyoming Senator Cynthia Lummis, are favorable to the idea of Bitcoin as a form of 'digital gold,' but would rather see its surrounding privacy features be away with.

Not so SEC Commissioner Hester Pierce.

Privacy is Normal

At the Science of Blockchain Conference, Pierce found stern words for her fellow financial regulators. Technology that does not necessitate a intermediary to conduct financial transactions should be embraced, not feared.

Pierce begins her speech with a anecdote on how telecommunications required an intermediary to connect phone lines from A to B. By this analogy, she goes on to describe that many of our current laws and regulations are not fit for the digital age, and should be drastically rethought. The third party doctrine, which governs that US Americans cannot expect privacy when giving up their information to third parties, was quite literally based on the idea that telephone conversations would be conducted via another human being, Pierce explains, describing how this same legal principle now serves as a cornerstone for the enactment of the Bank Secrecy Act (BSA). When our transactions are executed by third parties, the Fourth Amendment becomes void.

Governments and policy-making bodies around the world, like the White House and the FATF, would now like to see BSA-like reporting requirements extended toward non-custodial, peer-to-peer digital asset frameworks to fight money laundering and terrorist financing. But "doing so would deputize us to surveil our neighbors—a practice antithetical to a free society," Pierce argues. "We should not ask peers transacting with one another, where no intermediary exists, to collect and report information on each other."

Pierce argues that we should welcome privacy-preserving technologies and protect developers of open-source privacy software, rather than trying to hold them accountable for the actions of their users, referencing a recent talk given by PGP inventor Phil Zimmerman at the Bitcoin Conference to protect end-to-end encryption, as well as remarks made by cypherpunk mailinglist creator Eric Hughes, who stated that "we cannot expect governments, corporations, or other large, faceless organizations to grant us privacy out of their beneficence.”

Pierce highlights that the Cypherpunk's advocacy is well reflected in our common understanding of privacy today. 83 percent of respondents agreed that the government should need a warrant to access financial records, and 79 percent thought it unreasonable for a bank to share a customer’s records with the government, Pierce cites a survey conducted by Cato Institute.

"Privacy pools and mixers enable a person to keep private her compensation, her donations to charity, her associations with political or religious organizations, and her purchases," says Pierce, citing a Supreme Court decision from 1958 which found that the "inviolability of privacy in group association may in many circumstances be indispensable to preservation of freedom of association."

Instead of applying the "sledgehammer" that is the BSA, law enforcement has other tools to combat crime, Pierce argues – noting that BSA reporting is not as effective as some might think.

The BSA is Costly and Ineffective

"The Bank Secrecy Act deputized American financial institutions as de facto law enforcement investigators,” Pierce cites Cato Institute's (and The Rage contributor) Nicholas Anthony.

The government has created a when-in-doubt-file dynamic, says Pierce, noting that financial institutions filed millions of suspicious activity reports (SARs) per year, with little effect on law enforcement success. Instead, BSA regulations cause financial institutions to “see red in every flag and file unnecessary SARs," imposing extra costs on firms and adding unhelpful clutter to the reporting data, making it less useful in the end. Stories of innocent people suffering harm because of the elaborate financial surveillance infrastructure have added to calls for rethinking the government’s approach, Pierce adds, citing an article by Reason that highlights how Government requests can cause banks to sever customer relationships.

A helpful input to reform discussions on the BSA would be good data about how useful information collected is, as the number of SARs and CTRs filed does not tell us whether or how they were used, Pierce says, adding that "we should consider with fresh eyes whether these measures are proportionate to the threats we face and whether they diminish the liberties that make the United States a beacon for the rest of the world."

"Most fears of financial privacy and the technology that enables it flow from a genuine desire to protect this nation from enemies and criminals," Pierce concludes. "Safeguarding our families, communities, and country from harm is extremely important, but curtailing financial privacy and impeding disintermediating technologies are the wrong approach. Denying people financial privacy—whether through sweeping surveillance programs or restrictions on privacy-protecting technologies— undermines the fabric and freedoms of our families, communities, and nation."

"The American people and their government should guard zealously people’s right to live private lives and to use technologies that enable them to do so," and "technologies that have legitimate uses are better left in the permissionless, available-for-all-to-use category, even though doing so enables people to use them for bad purposes, because taking any other course would impinge fundamental liberties."

Independent journalism does not finance itself. If you enjoyed this article, please consider making a donation. If you would like to note a correction to this article, please email corrections@therage.co