BTC, Saylor's Version: The Arsonist in the Fire Department

Privacy on the Bitcoin baselayer may be counterproductive to Bitcoin as an investment asset, but it surely is counterproductive to the business goals of a corporation dealing in the evaluation of intelligence.

A few weeks ago, allegations against MicroStrategy co-founder and Executive Chairman Michael Saylor claimed that the 'Bitcoin Gigachad' had kept ETF issuers from donating profits to Bitcoin Core developers.

In a recent interview, Saylor addressed the funding controversy, stating that „I think we should fund developers in a surgical way knowing what their priorities and principles are,“ and that "the criticism I got on this topic is pointing out to certain Wall Street firms that maybe it's not a good look to provide unlimited, ungoverned funding to development efforts that might destabilize the network."

Some see Saylor's attempts at influencing Bitcoin Core funding as an issue, but many have criticized Saylor's quotes on Bitcoin development funding to have been taken out of context. In the interview, Saylor refers to the implementation of Ethereum-like features on Bitcoin, which he deems undesirable.

“Stop talking about regulatory arbitrage. Censorship-resistance, privacy, and tax evasion are bad ideas. We hate that.”

In 2020, Saylor gave an interview to BTC Times which since appears to have been taken offline, describing what could fuel more institutional Bitcoin adoption. Elaine Ou, who led the interview, describes the conversation as "a huge letdown."

Saylor explains that people in Bitcoin should "stop talking about regulatory arbitrage. Censorship-resistance, privacy, and tax evasion are bad ideas. We hate that." [...] “People with billions of dollars don’t want to invest in crypto networks that support anarchists.”

Saylor expresses that Bitcoin should not be emphasized as a currency. "Bitcoin not only competes with the Treasury and the Federal Reserve, it also implies a payment network to compete with Square, Apple Pay, Alipay, and other services that are both faster and cheaper. Maybe that’s why even the venture capitalists on Sand Hill Road still struggle with Bitcoin as a technology. They see it as either a bet on the collapse of Western Civilization, or a heavily impaired PayPal," writes Ou.

According to Saylor, Bitcoin should be treated as an investment. "Every company, every organization has the same problem: How do I conserve my money? When fiat currencies are debasing, that means every single investment is probably being inflated away.”

In an interview with Peter McCormack, Saylor reiterates his takes on Bitcoin privacy: "I think that there's a $50 Trillion requirement to store your money in a way that you don't lose it all. And I think that there's a much smaller requirement to store money in a privacy wallet [...] If Bitcoin diverted all of their energy to make itself private and became known as a network of complete and utter privacy, it probably is counter productive to its own interests, because you don't really want the United States government to say Bitcoin is completely private, because now it becomes the perfect tool for money laundering, now it becomes the enemy, now we're going to shut it down."

From an investment perspective, there is not much to argue with Saylor's opinions on Bitcoin privacy. However, contrary to Saylor's apparent vision of Bitcoin's goals, the whitepaper did not describe Bitcoin as 'A Peer-to-Peer Electronic Investment Asset', but 'A Peer-to-Peer Electronic Cash System'; to which privacy is an inherent feature.

2021 SEC filings show that MicroStrategy had been exploring the integration of Blockchain Analytics into the MicroStrategy software suite, stating that "we believe that our bitcoin acquisition strategy is complementary to our enterprise analytics software and services business, as we believe that our bitcoin and related activities in support of the bitcoin network enhance awareness of our brand and can provide opportunities to secure new customers for our analytics offerings. We are also exploring opportunities to apply bitcoin related technologies such as blockchain analytics into our software offerings."

By 2022, in light of discussions on verifying Twitter users with real world identities to combat spam, Saylor appeared to have taken a more favorable stance on privacy in general, stating that "Twitter needs 396 million Orange Checks to evolve beyond the limits of 360 thousand Blue Checks. Everyone should have the right to be verified in a few seconds for a few sats without surrendering their privacy."

At the time, Saylor championed the conversation on a possible Lightning Network integration on Twitter. The Lightning Network gives users much better privacy protections compared to on-chain transactions, and surely is a large improvement over ID sign up suggestions, but as an onion routed network is largely insufficient in protecting users against nation state adversaries, as various papers on the security properties of the Tor network show.

MicroStrategy Federal Government Solutions

MicroStrategy is a business intelligence platform which provides its customers "access to AI-powered workflows, unlimited data sources, cloud-native technologies, and unparalleled performance to speed up time from data to action," aimed at "powering intelligence everywhere."

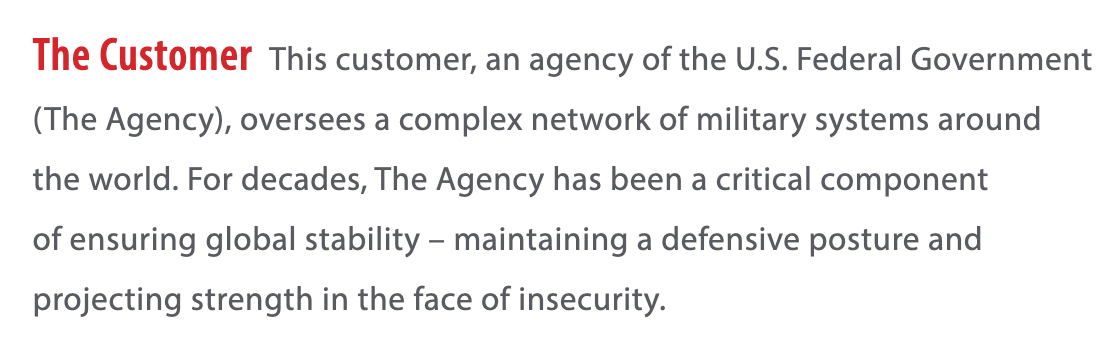

MicroStrategy offers tailored solutions to government entities, describing itself as "the industry’s #1 Enterprise Analytics platform." According to its own website, Microstrategy Federal Government solutions works with the Department of Defense, the Department of Homeland Security, the Deparment of State, the Department of the Navy, the Department of the Army, the Department of Justice, and the Defense Threat Reduction Agency.

In a blog post describing Cloudera's customer success story utilizing the MicroStrategy platform, MicroStrategy describes a government customer as "an agency of the U.S. Federal Government (The Agency), oversees a complex network of military systems around the world. For decades, The Agency has been a critical component of ensuring global stability – maintaining a defensive posture and projecting strenght in the face of insecurity."

According to the blog post, "The Agency had amassed and relied on a variety of disparate data systems to carry out its mission. These isolated, departmental data siloes limited leadership’s ability to maintain a 360-degree view of operations and core KPIs across the organization. With no centralized system for reporting, it was difficult and expensive to develop management-level reporting tools, and there was no way to enrich intelligence by blending in data from external sources. Also, due to the sensitive nature of The Agency’s data, strict security and governance protocols posed unique challenges."

To solve these issues, "The Agency selected a team of specialized vendors to provide cutting-edge technologies and expertise: MicroStrategy, Cloudera, Talend, and a MicroStrategy partner [...] to design, architect, and deploy a customized enterprise data management and analytics solution."

MicroStrategy herein provided "the ability to perform sophisticated analytics in an intuitive, visual interface," enabling "teams across The Agency to analyze a variety of large data sets — structured, unstructured, or otherwise — in a matter of clicks. Armed with powerful advanced analytics, users can run regression analyses, employ predictive functions, and use rich data discovery tools to determine performance metrics, operational costs, and productivity benchmarks."

Alleged Intelligence Ties Overshadow Saylor's Bitcoin Investments

Since Michael Saylor surfaced on the Bitcoin horizon, alleged ties to state intelligence have overshadowed his Bitcoin investments among his skeptics.

The Global Intelligence Files reveal that the intelligence contractor Stratfor, which "fronts as an intelligence publisher, but provides confidential intelligence services to large corporations, such as Bhopal's Dow Chemical Co., Lockheed Martin, Northrop Grumman, Raytheon and government agencies, including the US Department of Homeland Security, the US Marines and the US Defence Intelligence Agency," appears to have maintained MicroStrategy accounts.

Similarly, leaked emails of the notorious black-hat group Hacking Team, infamous for targeting human rights activists and journalists, show that the hacking group showed interest in products leveraging the MicroStrategy intelligence platform. Following the leak, Hacking Team members pivoted to spying on the blockchain for Coinbase. Hacking Team founder David Vincenzetti has since been arrested for attempted murder.

In a Data Visualization Evaluation presentation encompassing VAIO data mining projects, MicroStrategy's intelligence platform is described as "a leader in the BI space since 1989 and is one of the few vendors that provides and end to end BI solution." Sony appears to have purchased a MicroStrategy license in 2012. With the release of the Sony Files, the entertainment producer came under heavy scrutiny for "the flow of contacts and information" between the company, the US military industrial complex and the intelligence sector.

In the past, MicroStrategy appears to have sponsored White House meetings to develop plans for information infrastructure security, in which the need for private sector contributions were emphasized. Rick Blankenship, Account Manager Federal Intel at MicroStrategy, appears to have represented MicroStrategy in the Intelligence and National Security Alliance, "the premier not-for-profit, nonpartisan, private sector professional organization providing a structure and interactive forum for thought leadership, the sharing of ideas, and networking within the intelligence and national security communities."

Notably, Lisbeth Poulos, former Chief of Staff and Executive Vice President of Technology at InQTel, the non-profit venture capital arm of the CIA, appears to have began her career at MicroStrategy.

The open source transparency toolkit Intelligence Community Watch shows several connections between MicroStrategy and the US intelligence sector, whom I will not be naming here (you can search ICWatch's full database here).

ICWatch leverages secret codenames of US intelligence projects revealed in the Snowden leaks to query LinkedIn profiles to identify US intelligence agents. The project utilized "National Security Agency documents or names of special task forces or the, say, Joint Priority Effects List, the assassination program in Afghanistan, these were scraped out and then linked together so you can easily see, for example, who claims that they had worked at the National Security Agency at some stage or on various code-worded projects that the National Security Agency uses." After facing death threats by intelligence agents the software had identified, ICWatch was hosted by Wikileaks to protect the information the tool had gathered.

With Saylor's public attempts at influencing Bitcoin Core development, we may do good at wondering whether we have been cheering for the arsonist in the fire department when it comes to the use of Bitcoin as 'Freedom Money'. Furthering Privacy on the Bitcoin baselayer may be counterproductive to Bitcoin as an investment asset, but it surely is counterproductive to the business goals of a corporation dealing in the evaluation of intelligence.

Learn how intelligence communities undermine free software projects – Operation Orchestra presented at FOSDEM 2014